iInvest Securities’ Haydn Froggatt shows how options can be used to manage sharemarket pullbacks. Point Invest’s Jason Norval examines using put options to protect portfolios. MF & Co Asset Management’s Henry Fung outlines a covered call strategy to produce income.

Haydn Froggatt, iInvest Securities

With equity markets at all-time highs, there is a chance that stocks in your portfolio will at times underperform during FY22. In such times, the ASX Exchange Traded Options (ETO) market can provide some respite to recoup your losses or even increase your returns.

ETOs can be an important part of an investor’s toolbox. They are often utilised in a portfolio for risk-management purposes, extra income and leverage.

They can also be used to potentially increase returns on equity trades that have not been profitable.

To explain, if you bought a stock and it fell below your target price or break-even, you might consider using the stock-repair strategy to recoup the difference or even potentially increase the return.

This strategy involves buying one call option with a strike price around the current share price and then selling two call options with an exercise price as close as possible to the original purchase price or target price.

Ideally, there should be no cost to implementing the strategy as the income from the second sold call option should cover the cost of buying the call option.

This strategy effectively gives the investor the opportunity to gain from a rise in the share price and additional gain from the stock-repair strategy.

Example

You have bought shares in company X at $30 and it is now trading at $28.50. You would like to sell the stock when it gets to the purchase price (or an equivalent return).

Action taken:

- Buy the $29 to $30 call spread (which means you buy the $29 call and sell the $30 call in stock X)

- Sell an additional $30 call option in stock X, which will fund the purchase of the call spread.

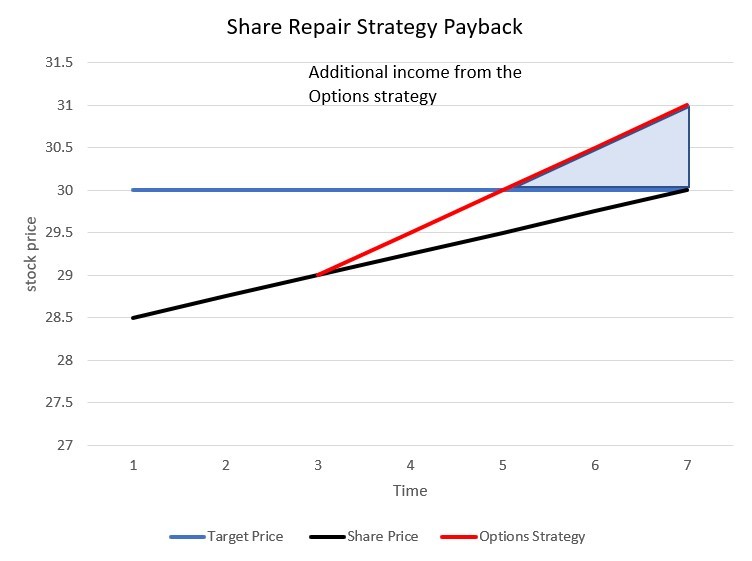

As shown in the chart below, if the share price rises, the strategy (highlighted by the red line) will result in bringing in additional income for you, effectively achieving the target price earlier than may be the case.

Importantly, if the share price rises above $30, the additional sold option will be exercised, and you will contractually have to sell your shares at this price. This means you will not gain from any further rise in the value of the shares themselves.

As shown in the chart, if the share price is at $30 or higher at the time the option expires, you will have not only achieved your target price but now also have an additional profit from the options strategy of $1.

The options strategy does not result in further losses if the share price drops.

Insurance for your portfolio

Jason Norval, Point Invest

The last 18 months have been a turbulent period for the markets and in our lives. To say that it has been a rollercoaster ride would be somewhat of an understatement, yet here we are at all-time highs (the S&P/ASX 200 index is approaching 7,400 as I write this article), after the quickest and largest recovery in history.

This has resulted in a great deal of value being added to portfolios for institutions, high-net-worths, SMSFs and retail clients. The big question is: ‘Where to from here?’

The market could continue to push higher, but what if there is another sell-off? Covid is by no means over, and the question of rising interest rates looms over the market. All the profit that has been made could just as easily be wiped out. One way to protect against another sell-off is by using options to purchase put protection.

Put Option

A put option gives the buyer the right, but not the obligation, to sell an underlying asset at a specified price on or before a specified date in the future. The buyer must pay the seller of the option a premium to have this right.

When put options are purchased over the S&P/ASX 200 index (XJO), they appreciate as the market sells off. This can be used for trading purposes (buying and selling at a profit), or to protect an underlying portfolio.

As the overall market sells off, a portfolio loses value, while a bought put appreciates in value to counteract and offset the loss. In this example, it is much like insurance. We pay to protect our car, our house and our valuables. Why not our portfolios?

Chart: S&P/ASX 200 index (XJO) over three years

Example

- XJO currently 7,368.9.

- $300,000 portfolio.

- Purchase 10 x XJO options at a strike of 7,000.

- Expiry: September 16, 2021.

- Cost – $10,000

If the XJO index were to sell off approximately 10% to around 6,600, these options would be worth $40,000 on September 16 (expiry).

The portfolio may have lost approximately $30,000, but this has been offset by an appreciation of $30,000 in the options. Therefore, the portfolio has achieved effective downside protection.

These put options can also be purchased without owning a portfolio, with the aim of generating a profit. The example above looked at a 10% sell off, but what if the market sold off 20%?

Those same 7,000 September XJO options that cost $10,000 would now be worth around $110,000 (at expiry). This demonstrates the potential upside in trading options.

It is important to note that the downside in this strategy is simply the cost of the options ($10,000). When buying options, the maximum loss is the amount you pay for the options, which is important when managing risk.

The bought put protection strategy can be utilised over any optionable stock on the ASX 200.

The strategy can also be used in conjunction with a variety of other options strategies, some of which could reduce the cost of protection.

It is important to speak to a derivatives expert when choosing which strategy is appropriate. There are many “options” available!

Creating income from a range-bound stock

Henry Fung, MF & Co Asset Management

A covered call strategy is an options strategy that involves selling an option over a stock that you already own. Since selling the option contract gives the right (but not the obligation) to the buyer to purchase the stock from you, owning the underlying stock so that you can deliver is what makes this strategy “covered”.

As the owner of the underlying stock, you have the right to sell the stock whenever you want. If you decide to sell a call option over the stock, you are effectively selling that right to the buyer of the contract. This contract has a specific time (expiry date) and an agreed selling price (strike price).

In exchange for your right to sell, you will receive a fee (premium) from the buyer of the contract. This premium is paid to you in cash regardless of whether the options contract is exercised by the buyer or not.

How a covered call works

A buyer of a call option will generally exercise his or her option if the stock price is above the strike price and not exercise if it is below.

(Editor’s note: Do not read the following ideas as a recommendation. Do further research of your own or talk to a financial adviser before acting on themes in this article).

Let us say, for example, you sold a Sydney Airport (ASX: SYD) call option with a strike of $5.90 for 15 cents. In both scenarios, you keep the 15 cents premium as a cash profit.

If SYD rallies and is now trading at $6.00, it makes sense for the buyer to exercise the option and buy your stock off you at $5.90, 10 cents cheaper than off the market. This option is called in-the-money (ITM).

On the flip side, if SYD drops to $5.80, the buyer of the option likely won’t exercise as the stock can be bought off the market for 10 cents cheaper. The option expires worthless and is called out-of-the-money (OTM).

The goal of a covered call, especially if you want to keep the stock, is for the call option to expire OTM.

The risk of an exercise can be eliminated, however. By selling a European option [a European option refers to contracts that give the investor the right to buy, or sell, an asset at a specific price on a certain date], the buyer can only exercise the option on the expiry date. This allows you to buy back the option from the market if the option is ITM and you want to avoid exercise.

Pros and Cons

The key is knowing what stocks this strategy is best suited for, to minimise the cons.

This strategy is a great way to generate a monthly income on a stock that is range-bound by selling an option at the top of the range. As an example, SYD could be a candidate for this strategy because of its range-bound stock price due to closed borders, in my opinion.

However, this is also a risk. If our borders open and SYD rallies, this strategy will cap the upside that you would participate in if you only held the stock.

With that in mind, picking the right stock in the right environment can make the covered call strategy a highly lucrative one.